How to Run a Good Startup Advisor Program

We ran an advisor program at Modern Treasury that I think every startup should copy.

December 2025

We ran an advisor program at Modern Treasury that I think every startup should copy. The way we ran the program extended the reach and broadened the impact of our advisor program compared to any I’ve seen at other startups.

What Advisors Did For Us

Advisors did many things, including: emceeing panels at conferences, coming in for whiteboard sessions, introducing us to prospects, sharing product intel about competitors or past players in the market, or helping scope phenotypes for hires. In addition to these one-off things, there were three ongoing ways advisors contributed.

1. Provided Specific, Undiluted Advice

One thing I hadn’t thought about before this program was the different level of advice directed at founders versus non-founder executives. Founders and CEOs get tons of advice. Non-founder executives get less. And filtering advice through a game of telephone (from advisor to CEO to relevant executive) is lossy. It doesn’t lead to the same level of detailed, specific, and productive conversations. For example, we had an incredible advisor who had been a VP People and CPO. She coached our Head of People on specific projects and programs, something only that advisor could have done directly.

2. Showed Senior Leaders Our Commitment

Bringing on top-notch advisors showed our senior leaders we were investing in them. It helped us with retention, especially at the seniormost levels, because it extended the expertise they were training under to be more than just me, or the founders, or the executive team.

Practically for me, it took the pressure off. It meant I didn’t need to be the technical coach on every single topic my direct reports might need coaching on. The woman who ran marketing was superb, and I think she would say I coached her on plenty of topics. But she was also a more seasoned marketer than me, and I couldn’t out-market her on many topics. Plus there were topics that neither of us spiked on. So we sought help. That meant I could coach and mentor her on topics where I spiked, she ran with things she spiked on, and we used the expertise of advisors where we needed it.

3. Worked For Us

That VP of marketing was originally an advisor! We hired four VPs or department heads from our advisor program that I can remember.

This program really helped us find out who we wanted to hire. I learned, yet again, the banal lesson that pedigree doesn’t necessarily mean excellence. Luckily for me the starkest example of that happened with an advisor and not a hire.

That was actually an interesting story. This advisor was an early customer success manager at a company that sells in a completely different market (SMBs) with a lower price point and a very different type of customer relationship (transactional). She ended up running all of CS there after working her way up for more than a decade. But the company wasn’t a hot tech company that you might name drop at a YC event by saying something like “oh yeah, my advisor is from ABC company.” Despite that, because she had played so many different roles as the company grew to over 10,000 people, her hands-on experience was really useful in coaching our CS leaders. Interestingly, this advisor held monthly coaching sessions with two leaders from our CS team for the entire year. She was the single exception to the no-structure structure I described above.

She was so great we renewed her advisor agreement for a second year. And even now she’s in touch with our CS leaders personally. After her extended advisor period ran out, I recruited a new advisor to coach the CS team. This person had more senior roles at companies that were name-droppable. Her most recent one was a SaaS company that sold to medium and large companies with high ACV, so the parallels to Modern Treasury were clear. After she became an advisor she skipped calls and barely answered our emails. We regretted putting her in the program. Yet another reminder that name brands really don’t mean as much as specific experiences.

The Mechanics

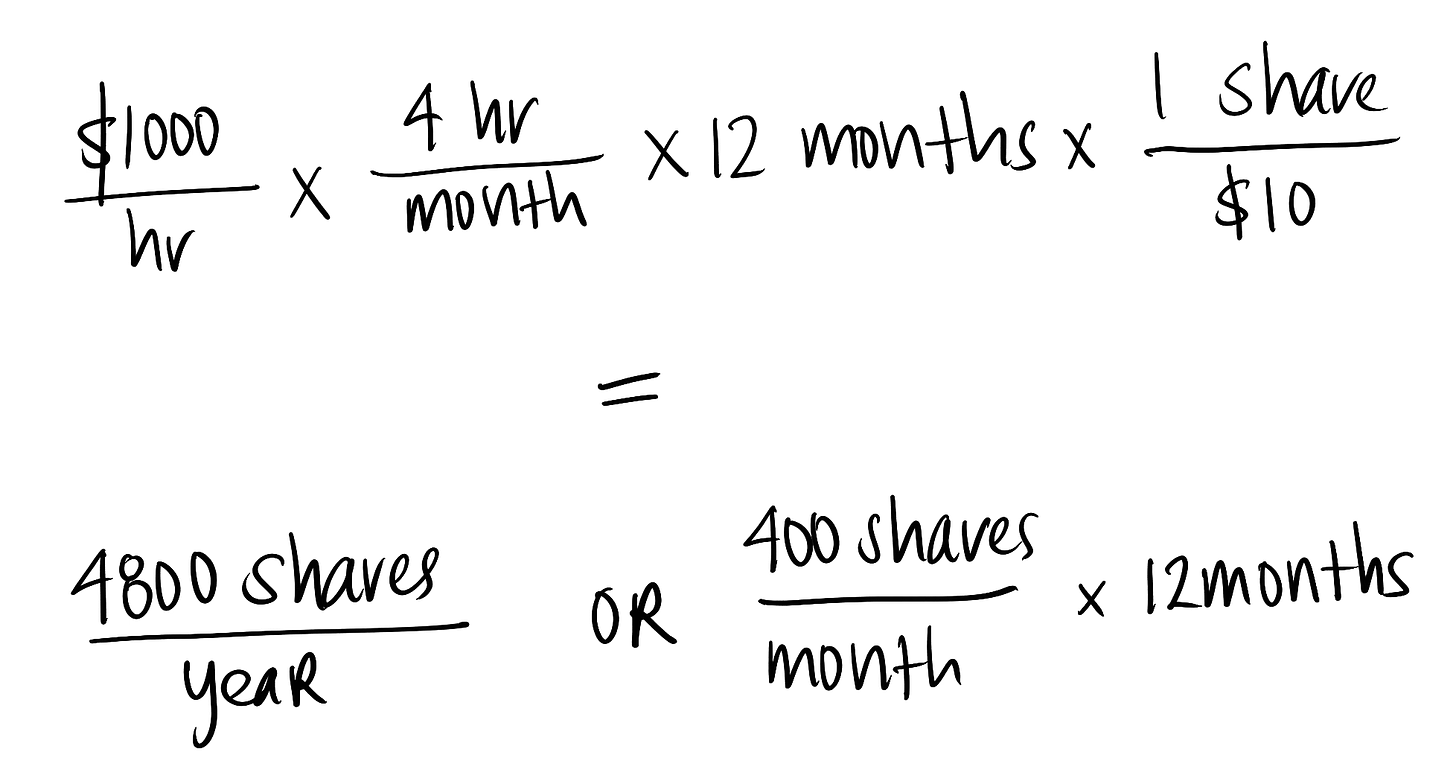

For each department,I used department very loosely here. Sometimes it was a team, sometimes it was a bigger group. the program had two slots. Advisors signed a standard agreement for one year that we could optionally extend for a second. They earned shares monthly based on a simple calculation of hourly rate and hours per month. Most advisors had high rates and we agreed to work together 2 or 4 hours per month. So the math for an advisor with a rate of $1K/hour, for 4 hours, at a $10 share price, was simply:

Even though vesting was based on monthly hours, the engagements weren’t highly structured. We usually used those hours in chunks, for example, a sales advisor spending a day at our sales team offsite. We’d engage ad hoc in between.

The program agreements became so standard that it was our Head of People who administered the paperwork, not our Head of Legal or Head of Finance. The agreement was just over one page and there was a one paragraph appendix for stock vesting.

Even though each department had two spots, in practice, most departments only had one advisor at a time. Some had periods with zero. But the reason we set up the program with two is twofold: first, once in a while advisors needed to overlap, and we didn’t want some petty rule to get in the way. But more importantly, having two slots set up a psychological phenomenon where bringing on an advisor never felt like firing your one shot. So it took away the sense of always being able to do better because if a truly better foundations engineering advisor came along, we could bring them in too. In practice, that never happened. It was just a trick of setting up the program that worked well.

Getting Advisors

Advisors came into the program a few different ways.

First, if the head of that department needed coaching in that area. They identified that need, or we did. For example, the woman who ran marketing for me was excellent. She was highly skilled in the communications, brand, and storytelling side of marketing. As we grew and needed to build more operational demand gen programs, we brought in an advisor who had run that engine at Mulesoft. That advisor helped us both.

Second, to extend or deepen our network. One of our investors might suggest someone that we should get close to or learn from. We had partners suggest people, too, and we even had partners change jobs then become advisors once they no longer had a conflict of interest.

Third, to capitalize on opportunistic relationships. The founders or I could meet someone that we thought would be useful, but we weren’t sure how yet. An example was my buyer at Cash App, who left Block a few years after they implemented Modern Treasury. As we were expanding our product into the workflow side of payment operations, I thought he could help us. I didn’t have a specific project, I just wanted to compensate him for being “on call” for our product, product marketing, and sales org as we brought that product to market. He ended up doing sessions with each of those teams that year.

Nothing Burgers That Actually Work Out

Sometimes advisors didn’t end up doing a ton during the year. But that turned out fine, too.

We ended up with ~25 people who were senior in the ecosystem who were connected to us and rooting for us: folks we could text when we needed something without feeling guilty about it. Sometimes a reference call is all we needed to set a deal, close a candidate, or get a partnership over the line. In a way, it was like each department had a short list of angel investors.

Lastly, and I think most importantly, the way we structured the program took any story away from getting an advisor. It didn’t have any negative connotation. They were just joining a program we had done 20 other times.

We didn’t run it perfectly. One thing I’d change is that not all departments used the program equally, and I would encourage or reward participation more strongly next time. But in any case, I will 100% implement this at the next company I join. It was really useful.